Methodical Trading - Volume 16 - "Ethereum All Time High & The Birth of Alt Season" 🚀

Bitcoin, Ethereum, & Altcoins Galore

This volume of Methodical Trading is free for everyone! Please show us your Support and remember to Subscribe for free via our e-mail list. Happy New Year and cheers to an absolutely raging bull market!

Bitcoin has been consolidating and continues to compress within a tighter price range.

Ethereum has finally broken the previous All Time High and looks to be making bigger moves against the BTC pair.

Altcoins across the board are popping off and taking advantage of the breathing room Bitcoin has given us the past week. Due to the nature of the current market, Alts will be the primary focus of this Volume.

This Volume of Methodical Trading is sponsored by two great projects making headway in the DeFi space.

Ferrum Network focuses on interoperability protocols in order to connect blockchains together and enable the exchange of any digital asset for relatively small network fees. They allow for easier use of transferring funds across a variety of platforms and the staking mechanism within their project allows for passive yields. With over 45 projects currently using Ferrum’s DeFi staking technology, I fully expect Ferrum to continue growing in 2021.

The Solomon Project is also making great progress in the DeFi space in order to bring about the mainstream adoption of online cryptocurrency payments. As a plugin, this project allows an easy, open-source way for any entrepreneur to begin accepting cryptocurrency payments. Consumers receive the same protection as credit card payments, but are able to take advantage of lower fees, fewer barriers, and smart contracts to enable pre-order and escrow.

With the DeFi narrative beginning to take over the current bull market, I highly recommend following Ferrum Network and the Solomon Project as the market continues to mature. You can reach both of their respective websites by clicking on the names linked above!

Talking Points

Bitcoin Consolidation…

The Ethereum Rocket

Alt Season (Setups & Watchlist)

Grayscale & Options

Bitcoin Consolidation

Taking a look at the 4 hour, Bitcoin continues to consolidate here and compress tighter. Many traders can get chopped up here attempting to trade the price action in-between. The best way to go about this type of consolidation is to stay flat or take positions at Support/Resistance. For example, any tap of the lower trendline allows for a tight invalidation level with a good R:R ratio. Vice versa can be said for the upper trendline. Personally, I am not trading this price action within the consolidation region and would rather wait for a breakout and retest before taking a position. Rather than bet on a breakout in either direction, it’s in my best interest to let price action decide on a trend first. Altcoins are providing great setups across the board in comparison to the tight compression taking place here for Bitcoin. So there’s plenty of opportunity elsewhere.

A breakdown out of the large pennant would be quite worrisome for Bitcoin. Price would likely head lower towards the 4 hour 200 EMAs and possibly $30,000 once again if a breakdown were to occur. As it stands, the current market environment is favoring ETH and other Alts that are taking advantage of this time where Bitcoin consolidates and breathes.

If Bitcoin were to break out towards the upside, then the first stop would likely be the previous All Time High at $42,000. This would break the current market structure and allow for another parabolic move to take place as well if $42,000 is broken.

Ethereum Rocket

The Daily here for ETH/BTC appears to have flipped the 3300 sats from Resistance into Support. Price successfully held the 200EMA & 200MA (Green/Black) along with closing above the Resistance level a couple days ago. Price is currently testing the Higher Time Frame resistance once again in the large Gray region. For a more macro perspective, zooming out to the Weekly helps paint a bigger picture.

ETH/BTC looks to be tapping the High Time Frame resistance once again that has held up since late 2018. Several claims have been made that the current chart pattern fits the definition of an Inverse Head & Shoulders. For these patterns, a general rule of thumb is to see increasing volume in the Right Shoulder with relatively small or weaker volume in the Left Shoulder & Head. As it stands, Volume appears to be increasing over the past few weeks as price approaches the weekly supply zone. The previous taps at this region since late 2018 have all failed. However, the increasing volume and continuous taps here over the past few years are a good sign that ETH/BTC may finally rally hard once again. This would be incredibly bullish for ETH/USD and give room for Altcoins to continue moving as well. ETH/BTC is the key factor here and would help pave the way for Alts across the board to print massive gains in extremely short periods of time.

If price can break back above the Resistance, then the next High Time Frame level to pay attention to would be 5600 sats followed up by 7700 sats. As always, take each level one at a time and be patient for a confirmed breakout first! The Risk:Reward ratio is still very appealing if ETH/BTC breaks above the Gray region first.

With ETH/USD finally making fresh All Time Highs, the ETH/BTC is the more important chart to pay attention to. As it stands, breaking the larger resistances on ETH/BTC would lead to moves towards 5600 sats and 7700 sats respectively. IF the price of Bitcoin were to continue consolidating, then that would put ETH/USD at well over $2,500. So long as ETH can continue to outperform BTC, then this outcome should be expected as Ethereum rockets above the previous All Time High.

The Birth of Alt Season (Setups & Watchlist)

LINK/USD

For LINK, we’re currently seeing this coin trade in price discovery on it’s USD pair. The most ideal setup for a pullback would be a move down to the 4H demand zone at ~$18.50 region. At the moment, we currently have the hourly 200EMA residing in this region, and that’s also a key level we’d want to keep an eye on in the event of a pullback. In case we don’t pull back down to either of these regions, the alternative would be waiting for the hourly resistance at ~$22.70 to get flipped into support. From there, we’d maintain all of our market structure bullish, and likely continue up-trending into a new All Time High.

RSR/BTC

On the daily chart for RSR, we’re currently testing a major daily supply zone as resistance. If we can breakout and flip this zone into support, we may start heading for a few long term targets. For the time being, there’s still potential for us to get rejected and head back down to the bottom of range again, but any breakout above the range would likely see major expansion in the next few weeks to follow. This is one to add to your watchlist.

DEFIPERP

With DeFi being the narrative that is pushing Alt Season, the DEFIPERP Index on FTX looks to be a strong candidate for the remainder of 2021. This is a Short term Long position being taken, but it can easily remain a hold as long as the Bull Market holds up. This basket of 25 coins listed below can produce strong returns together if one is unsure which coins to trade/hold.

KNC, MKR, ZRX, REN, REP, SNX, COMP, TOMO, RUNE, CRV, DOT, LINK, MTA, SOL, CREAM, BAND, SRM, SUSHI, SWRV, AVAX, YFI, UNI, WNXM, AAVE, BAL

AAVE/USDT

AAVE/USDT provides a similar setup as well and appears to have just broken out followed up by a successful retest of the ascending triangle. AAVE should be a strong mover soon as long as BTC continues to consolidate and allow room for Alts to breathe. This is a fairly straight forward setup that breaks to the upside quite often due to the current market environment.

This is a quick note on the market conditions specifically for Alts. Several Alts have similar patterns as the setups listed above. Any of the DeFi coins listed in the DEFIPERP basket will likely pop one at a time. Keeping these on a separate watchlist to constantly scan is a good idea due to how correlated a majority of these coins are. Timing these coins and observing which ones break out first can provide simple setups for the coins that have not broken out yet. The setups above are just one of several dozen trade setups that can be taken in the days/weeks to come!

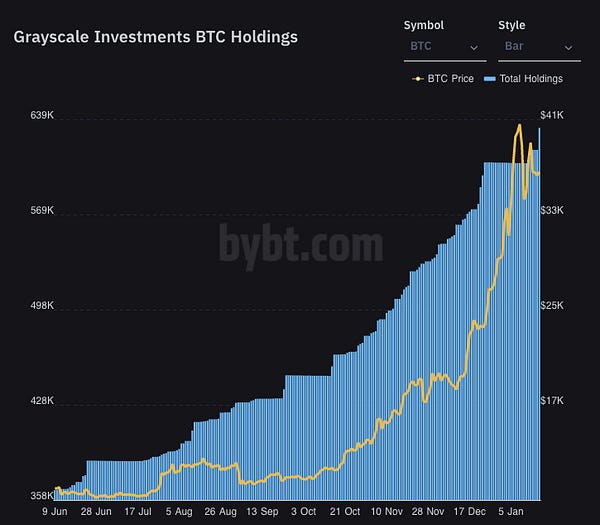

Grayscale & Options

Grayscale recently started accepting new clients to begin investing in their products. It is likely not a coincidence that this occurred around the time that Bitcoin dropped to $30,000 a little over a week ago.

They continue to purchases in large lumps and their Assets Under Management (AUM) continues to grow exponentially. The fact that Grayscale is still purchasing BTC and accepting new clients is a sign that the market still has room to run in the coming months.

Bitcoin Options also appear to be giving a hint as big volume pours in for $52k calls by the end of the month. You can read the full article in detail HERE by CoinDesk that shows the big bets coming in for $52,000 Bitcoin.

Please note that this newsletter is NOT Financial Advise. Neither Methodical Trading and/or it’s associates should be considered Financial Advisors. Any and ALL related Market centric material should be considered educational content for entertainment only. Methodical Trading and/or it’s associates are not responsible for any financial endeavors an individual/group chooses to take.