Methodical Trading - Volume 20 - "1 Trillion Dollars"🚀

Bitcoin Milestone, Ethereum Update, DeFi Alts, Exchanges, & Stimulus

This volume of Methodical Trading is free for everyone! Please show us your Support and remember to Subscribe for free via our e-mail list. 2021 is off to an amazing start in the markets so hats off to an absolutely amazing bull run!

Bitcoin breached $54,000 a few days ago and has officially reached the $1 Trillion Dollar Market Cap.

Ethereum has continued to fall behind against the BTC pairing, but their is still hope for ETH bulls still.

DeFi Alts have made some serious movements over the past 48 hours.

Exchange Tokens/Coins are popping off like BNB, FTT, and more.

Stimulus news makes it apparent that another big package is coming!

Talking Points

Bitcoin & $1,000,000,000,000

Ethereum’s Chance

DeFi Alts Making Way

Exchange Coins Moving!

More Stimulus On The Horizon?

Bitcoin & $1,000,000,000,000

Bitcoin has finally reached the inevitable 1 Trillion Dollar Market Cap. A true milestone for Bitcoin and all the active users around the world. The future appears to be bright for Bitcoin as it continues to mature from a “Speculative” asset into a more widely accepted and used crypto currency. An entirely new asset class is now being approached by Institutions similar to the Dot Com era. The great transfer of wealth has been set in motion as Investors who lived through the Dot Com bubble and Financial Crisis now get to experience one of the greatest bull runs ever seen! Although Bitcoin has gone from $3,600 to over $57,000 in the span of 11 months, the upside potential is still quite significant as the bull run itself continues.

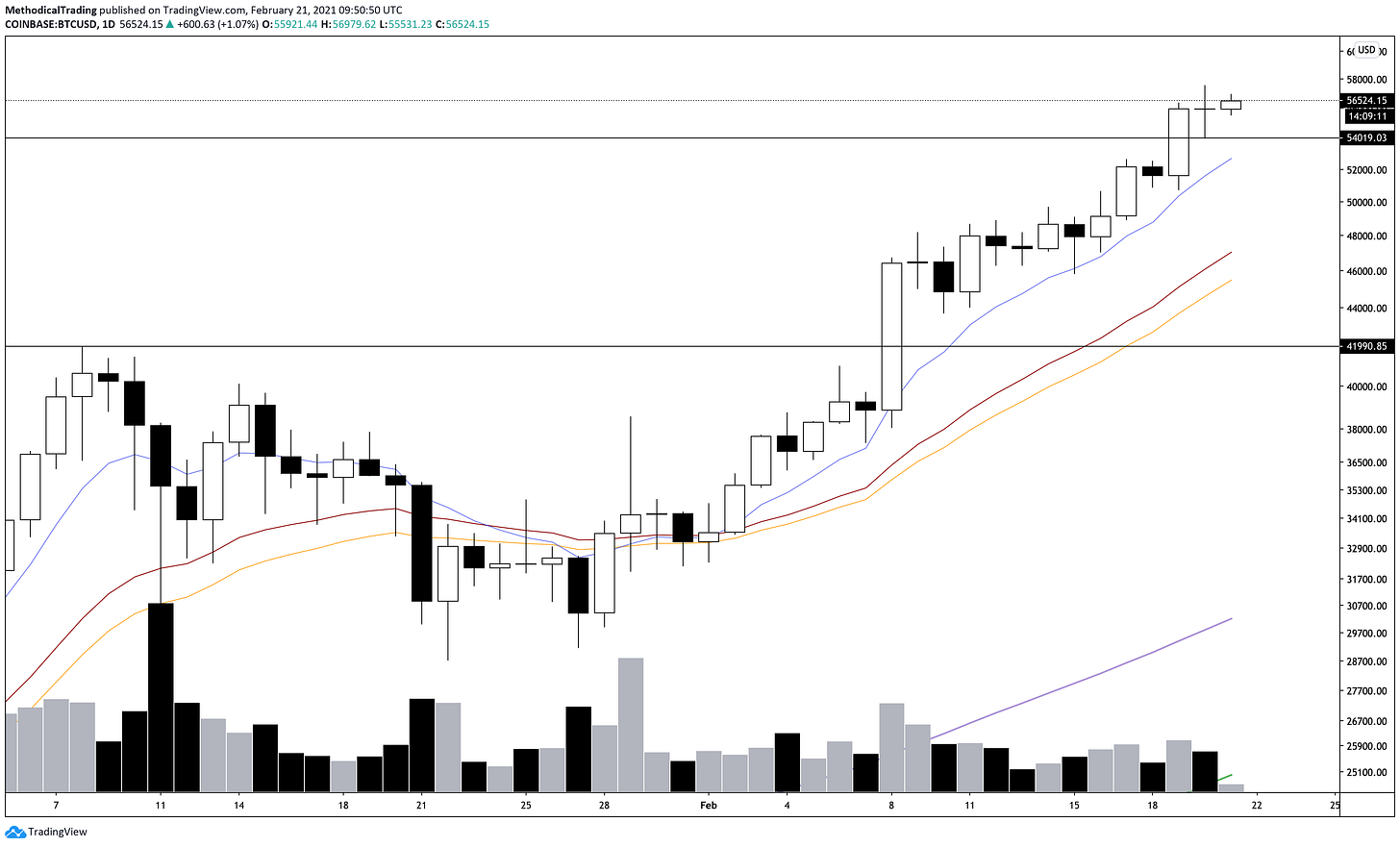

The Daily chart looks quite simple so far, price has continued to hold the EMA 8 (Blue) which is clear sign of a strong uptrend. As long as this EMA 8 is held, then Bitcoin should continue to move upwards in a bit of a parabolic movement. It is worth noting that the $54,000 level was the low from yesterday’s candle, which signifies that the 1 Trillion level is indeed a key region to pay attention to. If price were to break below the EMA 8, then the next EMA’s to look for would be the 21 & 26 (Brown/Orange) at roughly $47,500 and $45,000. These would be further EMA’s to pay attention to in order for Bitcoin to maintain a Short-Medium term uptrend.

Zooming into the 4 hour, take note of the pullbacks that are followed with consolidation and immediately resume the uptrend. The first two blue arrows show price holding the 21/26 EMA’s with the second one resulting in a relatively large wick downwards. If we apply these results to the wick that formed yesterday, then price has still held the 21/26 EMA’s along with holding the EMA 8 as well. Consolidation here appears to resemble the first Blue arrow that took place from February 10th-11th. It would seem like price is repeating this pattern again and may resume the uptrend during the U.S session.

A majority of institutions have begun looking into Bitcoin following Tesla’s big purchase and Michael Saylor’s conference with MicroStrategy. If heavy buying continues to come in during the U.S session, then investors can continue to speculate on whether or not (or which ones) Fortune 500 companies are converting some of their balance sheets into Bitcoin. Rumors are floating around that Apple could be the next big company to add Bitcoin, however, these are just rumors with no evidence to support it so far.

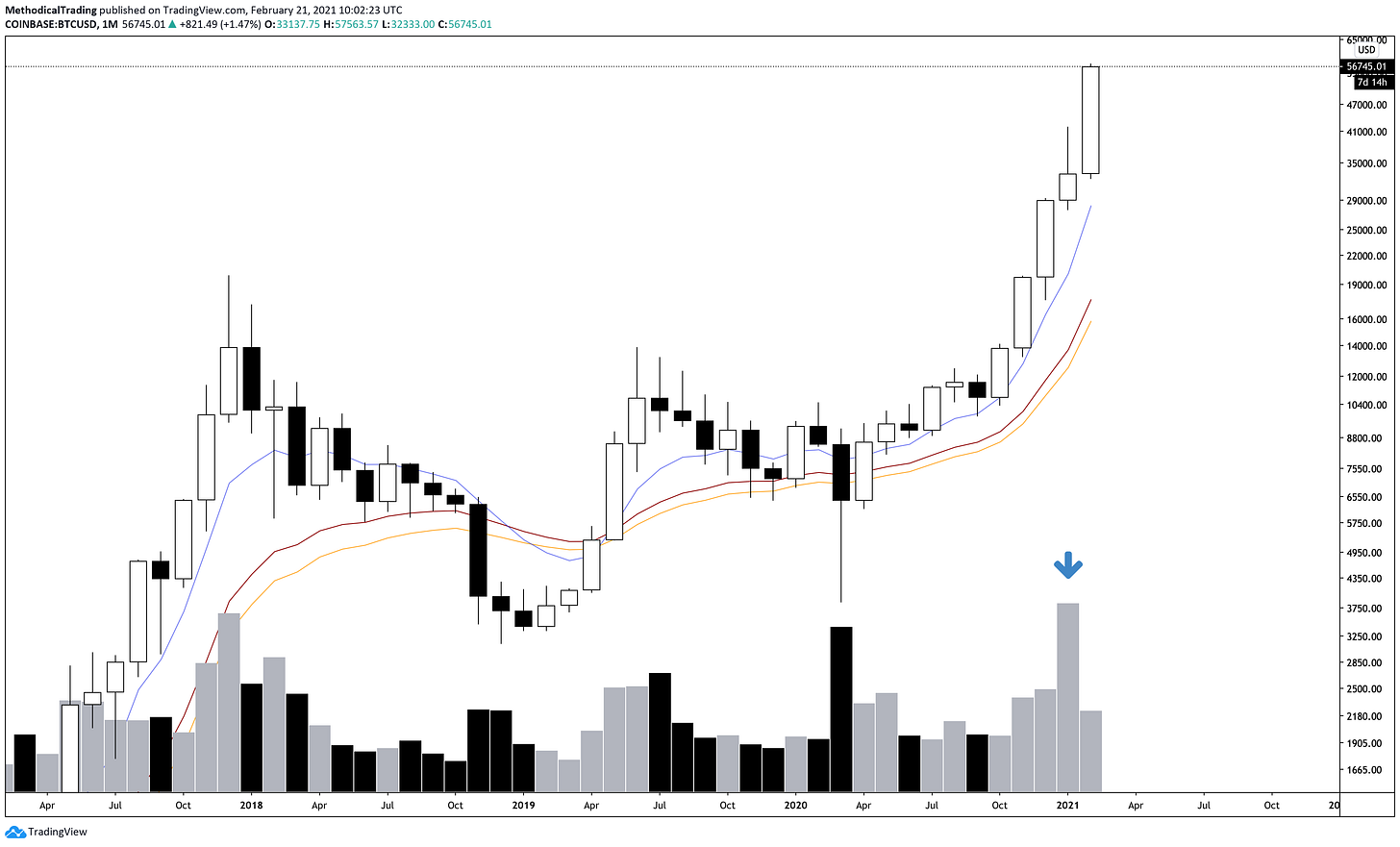

A quick glance at the Monthly chart shows that institutions are indeed coming in droves. The Bitcoin volume on Coinbase broke the previous Volume record that was set in December 2017 which was primarily fueled by Retail money. The current volume from the likes of MicroStrategy, Guggenheim, Tesla, etc. puts into perspective how important and large their buys are for Bitcoin. Generally speaking, Institutional money has a much longer term outlook in regards to their investments and/or assets they choose to help keep cash reserves afloat and beat inflation. Coinbase is the #1 exchange for OTC deals and is the primary exchange that Institutions in the U.S are going to flock to as time goes on.

If you don’t know already, Coinbase is going public on the Stock market and the valuation is absolutely out of this world. It makes sense after all… going public when the market is going parabolic and everyone wants in on it! This Coinbase IPO could also contribute to what puts Bitcoin ahead of everything else and prolongs this bull run. It seems that everybody, institutional or retail, will be owning something related to Bitcoin or other crypto currencies at some point in their own portfolios.

Ethereum’s Chance

Ethereum has had some nice price movement so far against the USD pair as it barely breached $2,000 before getting shot back down. Unfortunately, the BTC pair is not helping very much. ETH/BTC has not made a lot of headway since the previous newsletter where it was mentioned that price was losing the previous macro Support region. Price is now well under that region and needs to rally soon, otherwise Bitcoin will leave it all in the dust.

Taking a look at the Daily here, price actually retested the previous Support as Resistance before getting shot back down. ETH/BTC is now moving towards the 200 MA/EMA’s (Black/Green) that must be held in order for any sort of bullishness to remain in this pair. Make no mistake, the USD price of Ethereum CAN STILL GO UP while the BTC pair is going down. However, if ETH/BTC continues to fall while Bitcoin moves upwards, then it just means that you would have made more money staying in Bitcoin rather than Ethereum. Price absolutely must hold the 200 MA/EMA’s in order to justify diversification from BTC into ETH.

The most ideal scenario is for price to mean revert and reclaim the Gray box outlined above. This would likely mean that the BTC pair is continuing to set Higher Lows and that it will provide solid Long opportunities as long as the uptrend is intact. Pay close attention to this chart over the next couple weeks as it could be a strong indicator of whether or not ETH and other Alts can actually run hard!

DeFi Alts Making Way

DEFI-PERP Update:

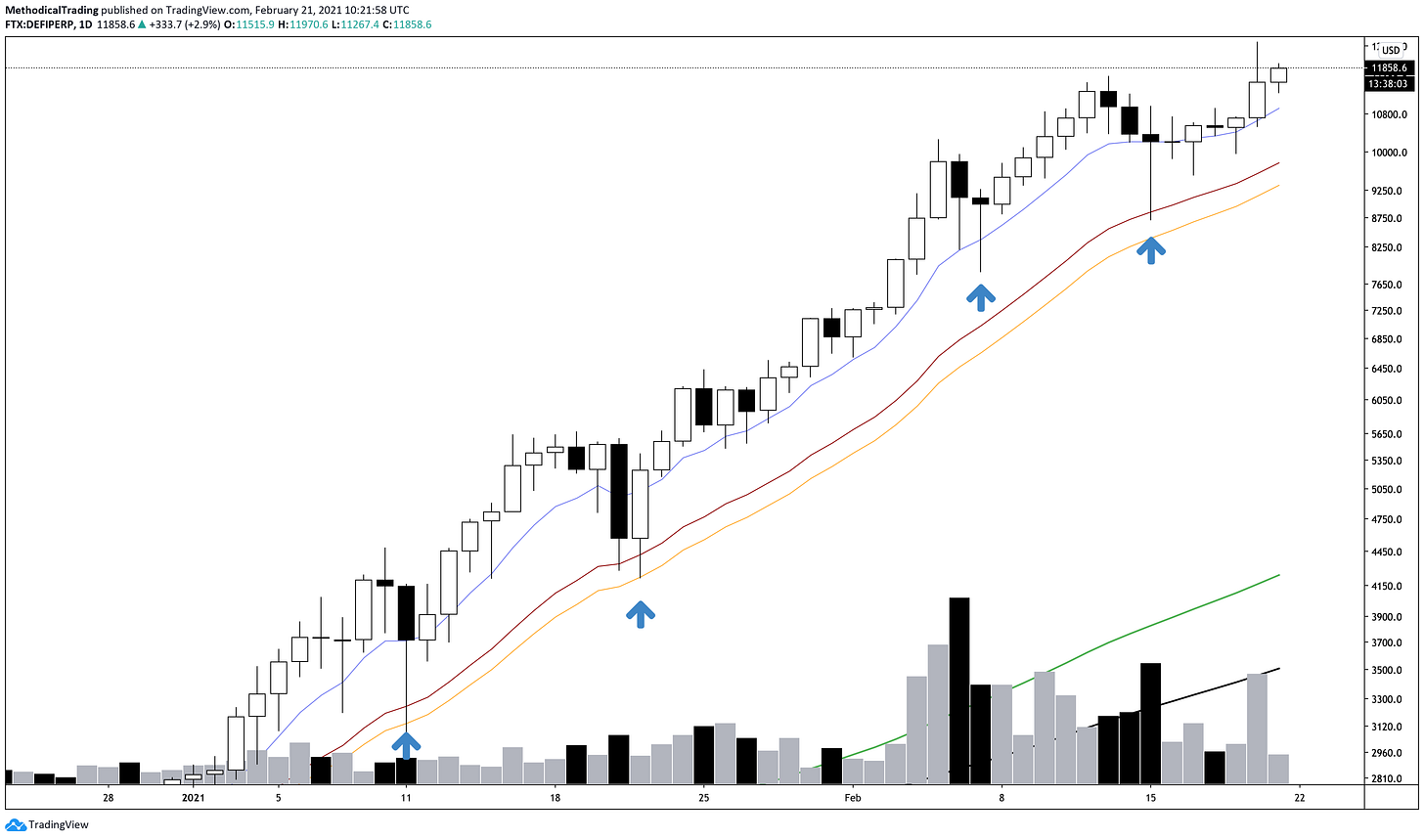

DeFi has continued to almost completely ignore and/or Bitcoin price movements so far for 2021. However, larger pullbacks still have an immediate effect on DeFi and every other Alt across the board. The difference here is that DeFi is being met with extremely strong buybacks that continue to propel the Index upwards. Take a look at the previous 4 hour wicks down in February. Each wick here on the Index has presented a strong buying opportunity and it is no secret that our team has been extremely bullish on DeFi over the past couple months. Coins such as UNI, SUSHI, SNX, YFI, etc. are all examples of strong uptrends that continue to hold up.

SNX/USD:

SNX is one of the few coins that have not popped yet. SUSHI, UNI, DOT, and a few other DeFi Alts have already broken out of consolidation to resume a strong uptrend. SNX appears to be primed here as well and is being compressed between the EMA 8 along with the EMA 21/26’s. A long opportunity here is to good to pass up on and targeting fresh All Time Highs makes sense as well. $40 SNX does not seem too far away if the uptrend continues to hold up.

AAVE/USD:

AAVE appears nearly identical to SNX as well. Price is consolidating and compressing between the EMA’s here and any break towards the upside should be met with fresh All Time Highs. A Stop Loss well below the 21/26 EMA’s would be a good way to avoid any sort of flash crashes and position size should be adjusted accordingly to accommodate for this. My risk is being managed here because the upside is already massive and could play out in a relatively short timeframe. Their is no need to get greedy when trading Alts that can explode upwards like this! Simply play it smart and position each trade accordingly.

Exchanges

BNB, FTT, and VGX have made absolutely monstrous moves since the beginning of the year. Their respective exchanges are Binance, FTX, and Voyager (VGX is primarily for U.S customers).

VGX/USD:

Over the past few years, Voyager has made headway into the U.S as a commission-free crypto exchange that is more preferred for Retail users. It beats out Coinbase in terms of fees by a large margin. The constant 1.99% or more fees on Coinbase have always been a painful entry into crypto, but was primarily a necessity for Retail money due to the lack of other options. Voyager has done well in listing assets, onboarding users, and making overall growth as time has gone on. They have finally expanded to all U.S states (except NY) and have been on a steady uptrend ever since. The Voyager Token has also made incredible growth as well… reaping in over 4,261% gains since the beginning of the year. This uptrend was likely a result of what happened with $GME, $AMC, and the Robinhood fiasco as well. U.S Retail traders wanted to get out of the Stock market and explore a more decentralized market. Voyager was one of the first options that popped up and their token has largely benefitted off that as well. The exchange has also introduced a new Loyalty Program & Token Utility Model as well. Their native exchange token (VGX) should continue to rise with other exchange coins as the crypto bull market continues. The Coinbase IPO may also be a large contributor to that as well. If you’re an investor that has yet to find a better option than exchanges with heavy fees, then Voyager may be a good option to go with. You can sign up for Voyager through this referral link HEREand receive $25 in Bitcoin as a reward once you trade $100. This is not a sponsorship, but rather a sharing of personal experience as an existing user.

BNB/USDT:

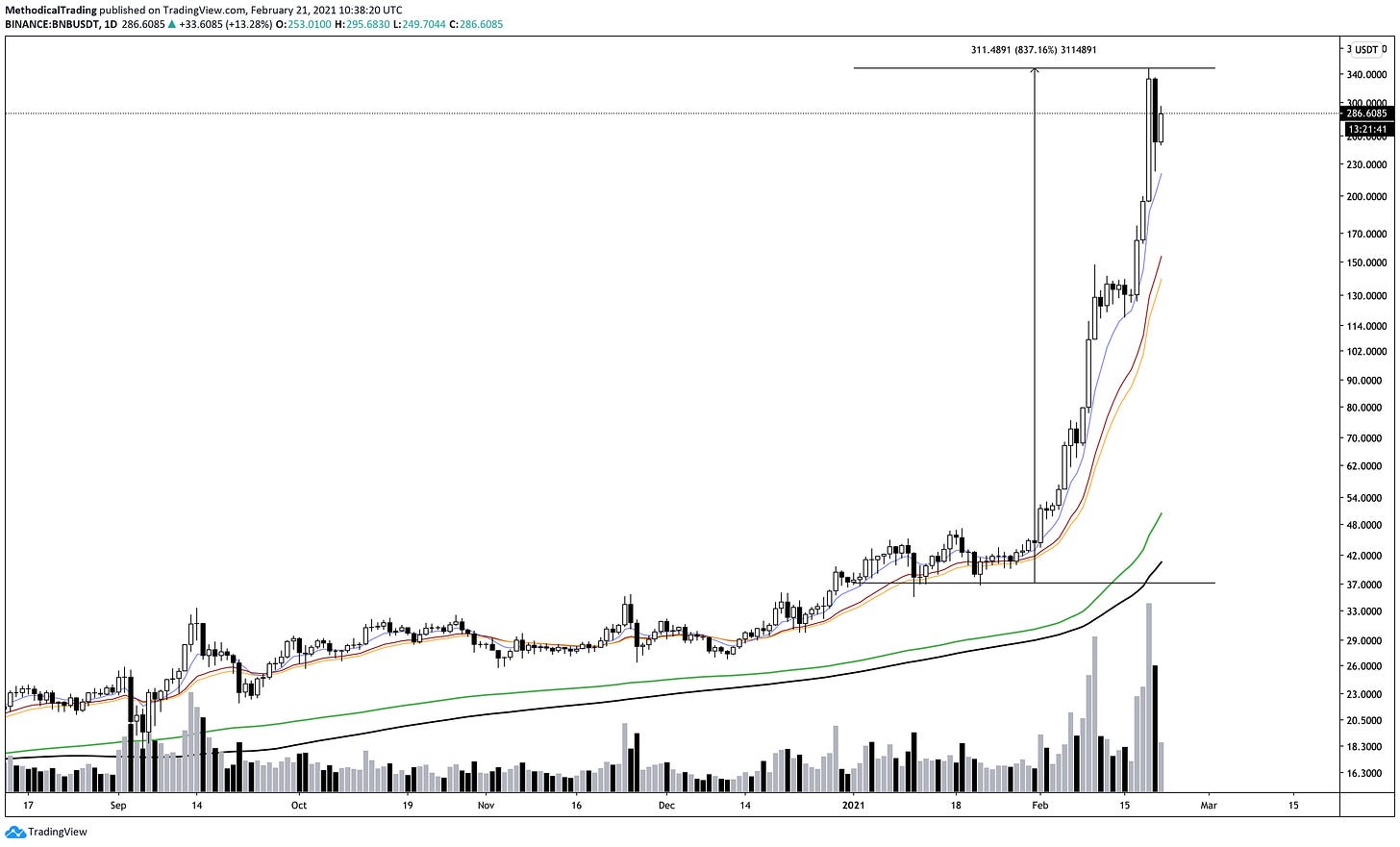

Not much can be said here for BNB other than wow! Price has pulled an over 800% move since the beginning of the year. One huge advantage that Binance has is the implementation of Binance Smart Chain. The cross-chain compatibility and low fees are what help contribute to the parabolic rise of BNB and the underlying tokens. If you don’t know what the Binance Smart Chain (BSC) is, then you can learn more by clicking on the link below. Fundamentally, exchange coins/tokens already have meaningful value all crypto currency investors alike. The rewards, staking, discount on fees, referrals, coin burns, etc. are all things that contribute to the rise of not just BNB, but all other exchange coins as well.

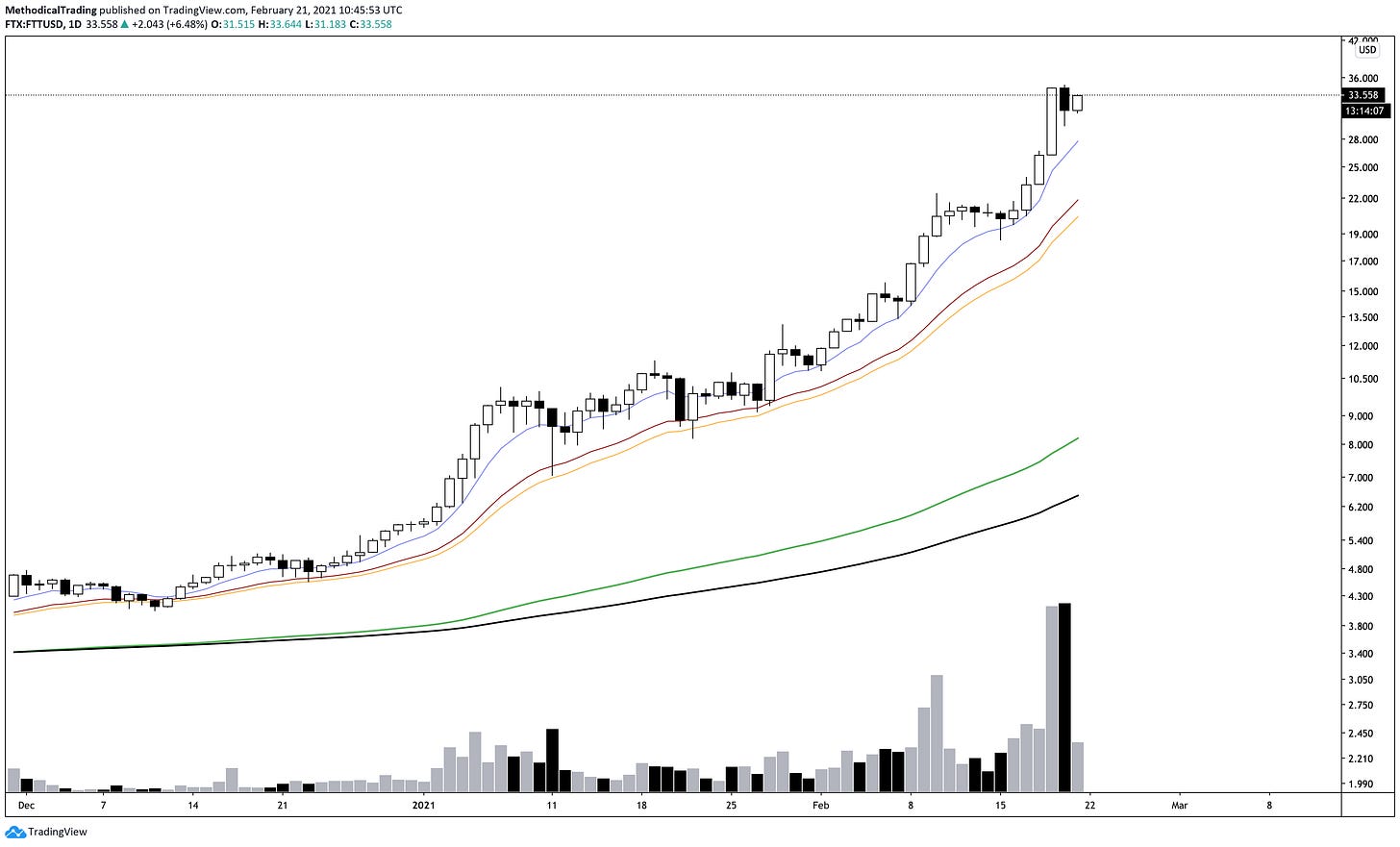

FTT/USD Update:

FTT has been mentioned several times in the past and buying the dips on it has continued to be quite rewarding. It cannot be stressed enough that FTT is a fundamentally strong play just like BNB. The growth FTX has made over the past few years is incredible and FTT is a direct competitor to Binance. Their daily volume continues to increase and consistent improvements proves that SBF is one of the best CEO’s out there in the crypto space. $100 FTT within the next few months should not be a surprise if it happens. If BNB can pull off a move like that, then their is no reason FTT cannot do the same either.

More Stimulus On The Horizon?

A third stimulus package following Biden’s Presidential win seems all the more likely at this point. It would appear that this package is coming much sooner rather than later. As always, Bitcoin and other chaos hedges will eat this up once this officially gets passed. It will only add to the narrative and primary reason for institutions to continue buying assets such as Bitcoin to fight off inflation and beat the U.S Dollar as it continues to lose value over time.

Keep calm and HODL on!

Please note that this newsletter is NOT Financial Advise. Neither Methodical Trading and/or it’s associates should be considered Financial Advisors. Any and ALL related Market centric material should be considered educational content for entertainment only. Methodical Trading and/or it’s associates are not responsible for any financial endeavors an individual/group chooses to take.